Chelsea Insurance Brokers: Jewellery Insurance

At the heart of all my work lies a desire to show my Instagram followers and readers the world’s very best jewellery, and to inspire them to acquire their own collection of treasures. However, there is a tendency among jewellery lovers – out of fear of losing or breaking their pieces, to ‘lock up’ their purchases in a safe – and it is there that they spend the majority of their time. To wear your jewellery in a carefree manner, and derive immeasurable pleasure from doing so, there is just one simple thing you need to do: insure it.

Jewellery, whether bought by you or gifted to you, often has strong emotional ties and to have your precious jewellery stolen, lost or accidentally damaged, can be devastating. At least with the right insurance you can replace or repair the item so that will be some consolation.

Mukhi Sisters ring with diamonds in 18k white gold, Ananaya earrings with diamonds and emeralds in 18k white gold, and ring Olesya's own

Recently, I met Olesya Chuksina, the Executive Director of Chelsea Insurance Brokers, a London-based company that specialises in various types of high value insurance. Thousands of people reach out to her every year to take out a policy that covers their most precious possessions, including jewellery worth millions pounds. However, it is worth insuring not just the most expensive diamonds, but also those items that cost a few thousand pounds. By paying a comparatively small sum each year for an insurance policy, you can stop worrying about the theft, loss or accidental damage of your favourite pieces – if something were to happen to them, they would be replaced with an item of comparable quality and value.

(Left to right) Mukhi Sisters ring with diamonds and 18k white gold, Ruwaya necklace with diamonds in 18k white gold, Ananaya earrings with diamonds and emeralds in 18k white gold, Ichien earrings with pink spinel and diamond in 18k white gold, watch and earrings Olesya's own

We cover jewellery worldwide and consider all types of risks including theft, loss and accidental damage. There are several stand-alone insurance policies and the core difference between them in how the claim is settled. While some insurers offer you a voucher in the event of a claim, others will provide you with your own dedicated claims handler who will work closely with you to find the right replacement. We only offer high quality stand-alone jewellery cover to our clients with no vouchers, Olesya tells me.

During our conversation I discovered that jewellery does not have to be insured with its own separate policy. It can be insured as part of a home insurance policy. Also, if you go to a respectable company like Chelsea Insurance Brokers, all the possible risks will be accounted for and you will be offered a policy that is valid worldwide.

Mukhi Sisters ring in diamonds and 18k white gold and Ruwaya necklace with diamonds in 18k yellow gold

“Many standard home insurance policies can only cover your jewellery up to a certain limit, which can be very low. However, as Chelsea only work with financially strong A+ rated insurers, they are used to working with high limits for jewellery cover.

For some reason I always thought that arranging insurance was a long and difficult process, but after speaking with the specialists at Chelsea Insurance Brokers it is now clear that I have been mistaken all this time. You can take out a policy to protect your valuables and personal possessions online and within minutes.

Ananaya earrings with diamonds and emeralds in 18k white gold

First you share all the requisite information about yourself and your jewellery then they explain all the insurance options and help you to choose the most suitable option for you, and finally they explain the terms and conditions, what it covers and the cost which, incidentally, is, in most cases, lower than you would expect.

It’s important to stress that all information you provide is kept strictly confidential and Chelsea do not and will not share any private client information with any third party.

Mukhi Sisters ring in diamonds and 18k gold and Ruwaya necklace with diamonds in 18k rose gold

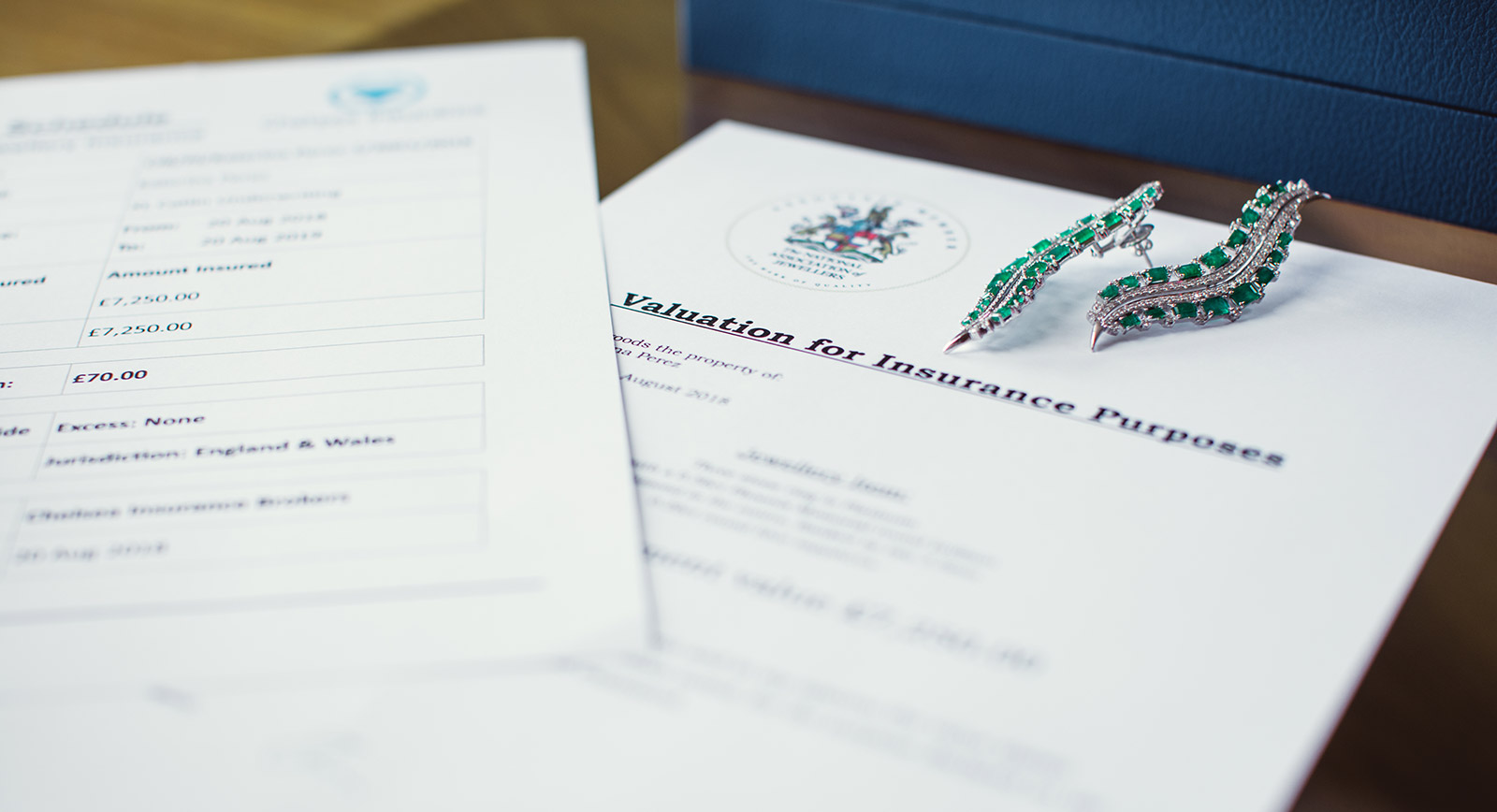

So what – apart from the jewellery itself – is needed to take out insurance? According to Chelsea Insurance Brokers: “we would only need either proof of purchase or a formal valuation document done within the last 3 years. If these are not available, we can refer a client to a London-based valuer or someone local to them. Another alternative is to use an online valuation service that we can recommend.”

Mukhi Sisters ring in diamonds and 18k gold, Ananaya earrings in diamonds and emeralds in 18k white gold and Ruwaya necklace with sapphires, diamonds in 18k rose gold

It’s often said insurance is only worth something when you need to claim! The last thing I will say is that it is a total myth that insurance companies do whatever they can to avoid providing compensation. At least, that is the case with Chelsea Insurance Brokers who, Are an approved Lloyd’s of London Coverholder, with policies underwritten by The Channel Syndicate, a leading global insurer & reinsurer. How the insurance claims process works is something I will cover next time.

WORDS

Katerina Perez is a jewellery insider, journalist and brand consultant with more than 15 years’ experience in the jewellery sector. Paris-based, Katerina has worked as a freelance journalist and content editor since 2011, writing articles for international publications. To share her jewellery knowledge and expertise, Katerina founded this website and launched her @katerina_perez Instagram in 2013.

Related Articles

Latest Stories

Add articles and images to your favourites. Just

Century of Splendour:Louis Vuitton Awakened Hands, Awakened Minds Chapter II

Creative Director Francesca Amfitheatrof offers her unique interpretation of a pivotal period in France’s history, marked by the French Revolution, the Napoleonic era, and the rise of industrialism

Jewels Katerina Perez Loves

Continue Reading

Writing Adventures:Co-Authoring the Book

Paraiba: The Legacy of a Color

Brand Focus: Louis Vuitton

Jewellery Insights straight to your inbox