Good Investment: What Makes Jewellery Rise in Value?

We love to talk about investing in a piece of fine jewellery as a way to justify our spending, but what actually does make for a good investment? Rachael Taylor picks up some hot tips from experts on how to curate a collection that will deliver returns.

When purchasing a piece of luxury jewellery, it is common to consider whether that jewel will offer not just pleasure for now but also a good investment for the future. Any jeweller worth their salt will tell you to follow your heart rather than your head when it comes to collecting, but the question remains: what makes a piece of jewellery go up in value?

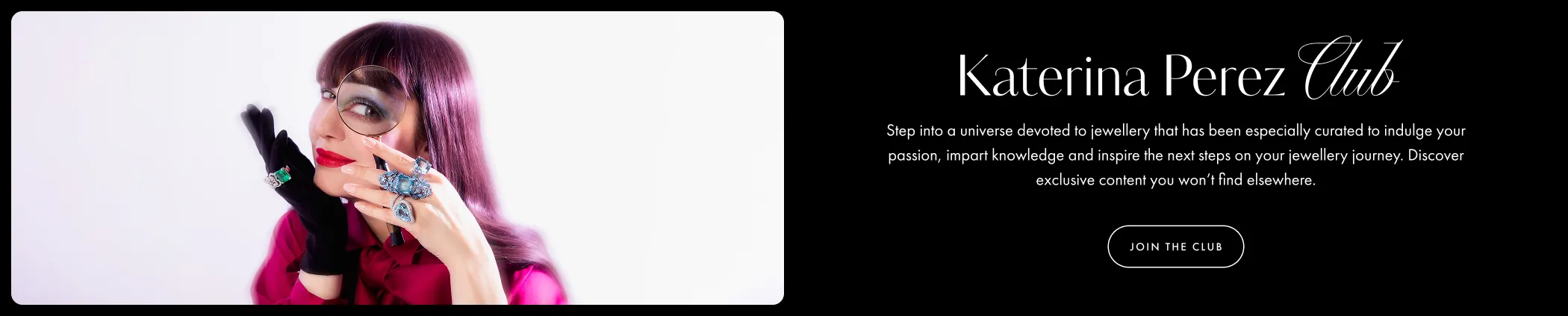

This story is available to Katerina Perez Club members.

Monthly access

Unlock Club features

£15/month

Billed monthly. Cancel anytime*

Annual access

Unlock Club Features

and save 13% on membership

£13/month

Billed annualy. Cancel any time*

All Membership Features

- Access to exclusive articles

- Daily bite-size news in Jewellery Chronicles

- Jewellery Calendar of events across the globe

- Curated list of articles from 50 other platforms

- Invites to online and offline KP Club events

- Receive Monthly Newsletter

- Save articles and Images into favourites

Already have an Account?