Colombian Emeralds: George Smith of International Emerald Exchange About Investing In Emeralds

In this interview, co-founder of International Emerald Exchange (IEEX) George Smith says it is essential to educate oneself about gemstones before investing in them. The young man exemplifies that it is not compulsory to be a gemmologist to obtain excellent knowledge and understanding of gemstones, in his case emeralds. Smith used to work for a hedge fund in London and assist wealthy clients with making the ‘right’ investment. However, four years ago, he decided to take his career path into a different direction.

Having moved to a country where the best emeralds “live” as well as his Colombia-born mother and family, Smith began to actively develop his knowledge and skills in emerald production and trade. It seemed the most logical and interesting profession to take on. For several years, Smith studied the details of business and co-founded his company IEEX, which sells fine Colombian emeralds to jewellers, designers and private customers. His passion for what he does as well as a perfect understanding of both capital investment and emerald trade left me with no choice but to discuss the subject of emeralds investment with Smith.

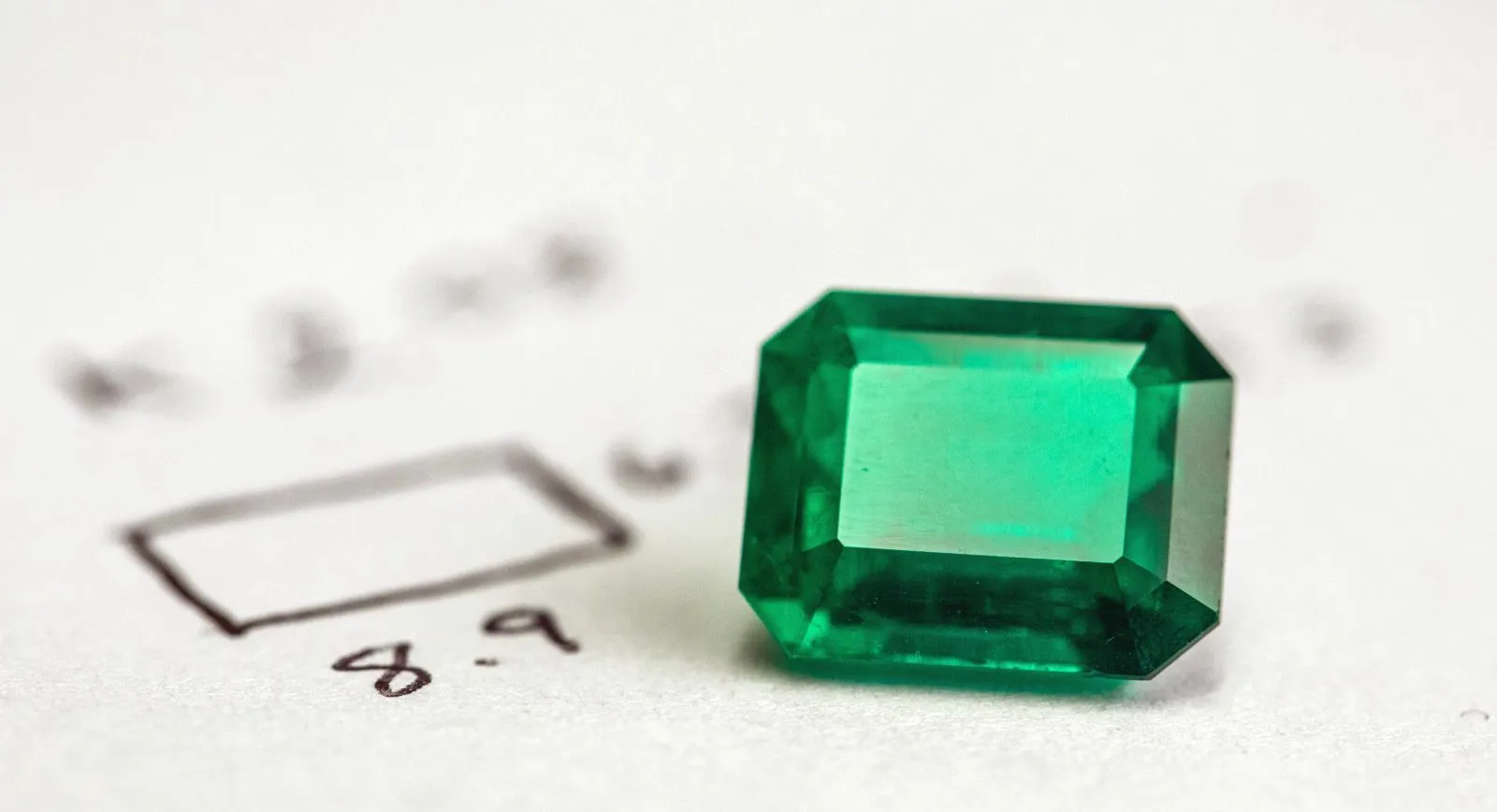

International Emerald Exchange rough emeralds. Photo credit: Juan Cristobal Cobo

Katerina Perez: Why is it advisable to invest in gemstones?

George Smith: If we look at gemstones as an asset class, they have been traded across the globe for thousands of years. Because of geopolitical events today and on-going conflicts across the world, rogue governments have the ability to potentially ‘turn off’ our lives, if all our money is in the bank account. But gemstones are a form of wealth that can’t be taken away; besides they can be passed down the generations. I am not saying that tomorrow you should put all your money into gemstones, but it is sensible to have a certain percentage of your wealth in alternative asset classes.

KP: What to bear in mind when looking for an investment stone?

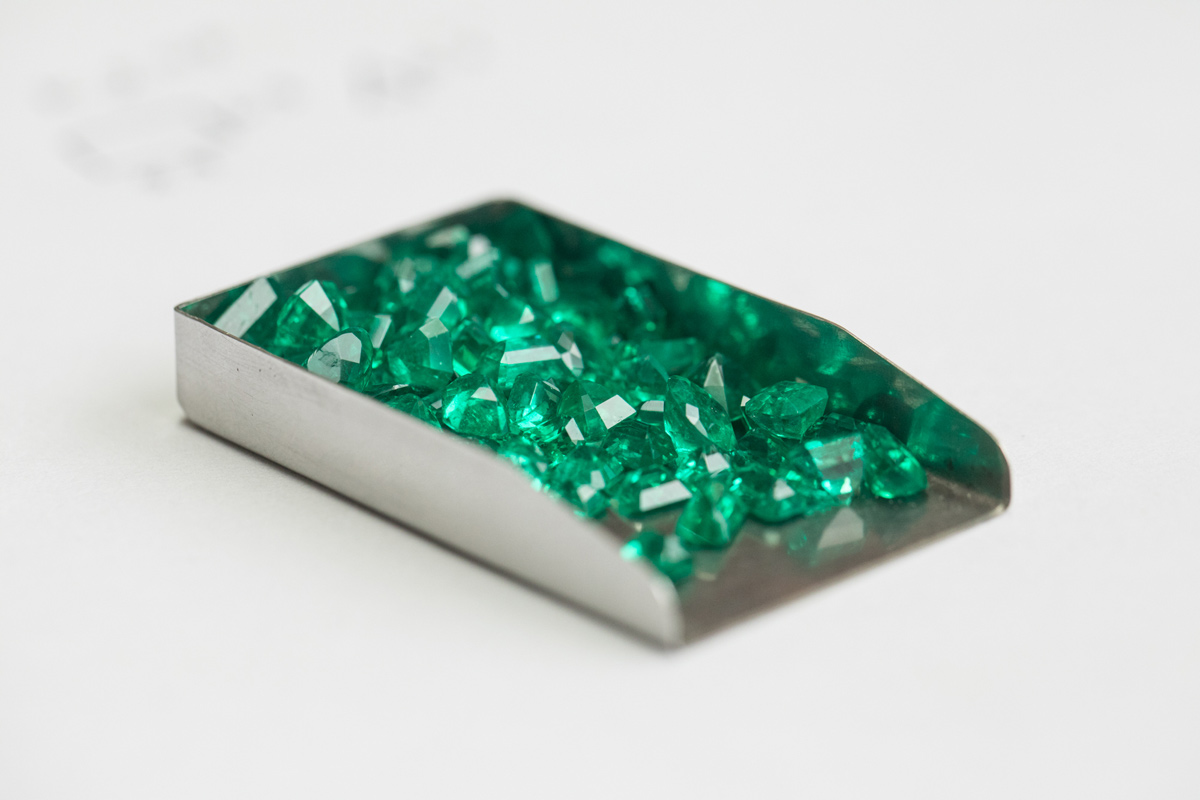

GS: If you want to invest in gems one thing is true across all of them – you need to buy the best-untreated stones of the finest colour and clarity. There’s always a market for the best of anything. Similarly, there will always be a market for Van Gogh paintings and there will always be someone who can buy an Aston Martin One-77. You know that the super-rich will always have exquisite taste and will always have money. It’s the middle class whose wealth fluctuates, but the super-rich will always be there.

International Emerald Exchange cut and polished Colombian emeralds. Photo credit: Juan Cristobal Cobo

KP: Why should one invest in an emerald?

GS: As far back as the times of Cleopatra when Egyptian emeralds were mined, they were treasured by humans the world over. Nowadays, it’s not uncommon for a superfine 10-carat emerald to fetch you over a $100,000 per carat. So, you can potentially take in a million dollars for a stone that is no bigger than the size of a thumb. It’s very easy to transport such gem in a ring or in a pair of earrings; you can do a lot of things with what is essentially one of the most concentrated forms of wealth on the planet.

KP: If my bank account is not measured in millions of pounds, will I still be able to buy an emerald that is considered an investment stone?

GS: Sure. I always say buy what you can afford but make sure that you always go for quality over the size. If someone comes to me with a $25,000 budget, I can sell the buyer a beautiful 10-carat emerald. However, I always try to steer them to the 1-2-carat option of the finer quality, because quality is rare. And rarity equals value. Personally, I would rather have something small but perfectly formed than something large with flaws.

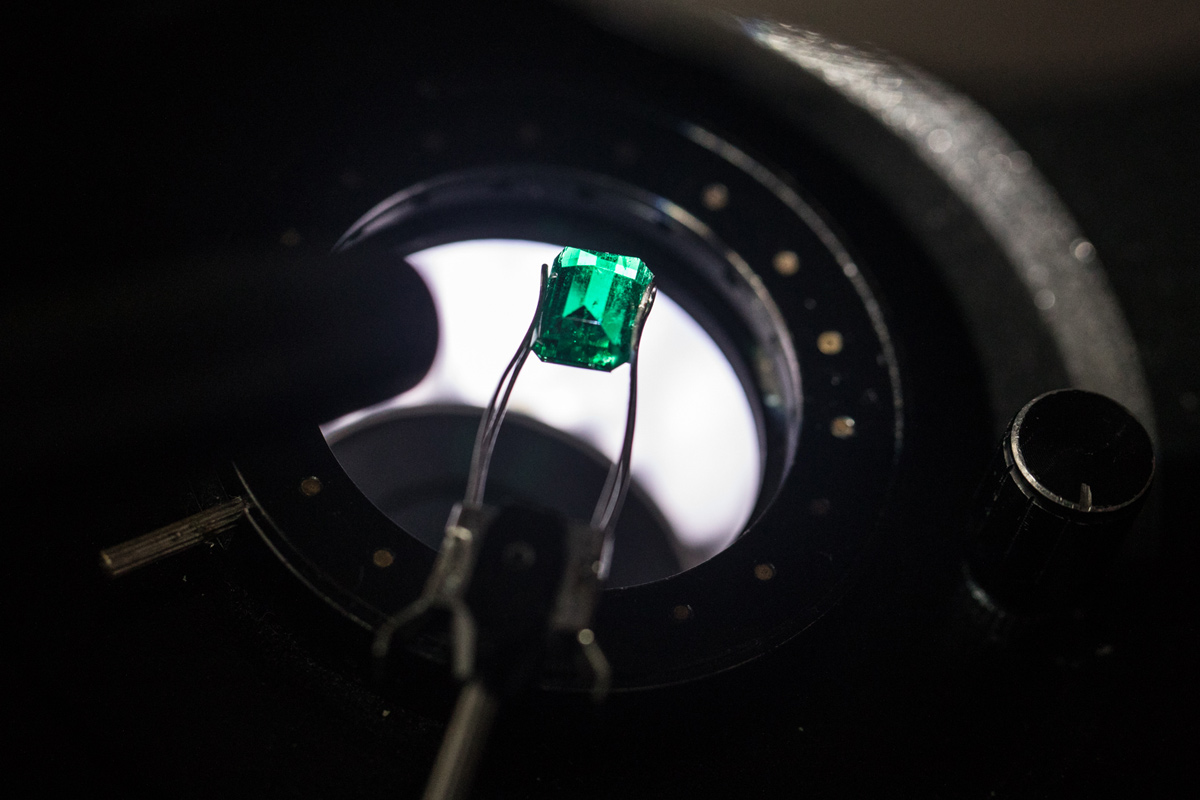

International Emerald Exchange cut and polished Colombian emerald under a microscope. Photo credit: Juan Cristobal Cobo

KP: Is a certificate always a guarantee of good quality?

GS: When I deal with clients I inform them about why the particular gem is good as an investment and why its characteristics are favourable. But I advise clients not to just take my word for it – I provide a certificate from a laboratory like SSEF (Switzerland) or Gubelin (Switzerland) or GCS (UK). There are many small independent laboratories out there whose opinion isn’t worth the paper it is written on. Having a certificate from a respected laboratory is the single most important thing you can do to protect yourself and the purchase.

KP: There are so many different things to take into consideration when buying a gemstone: colour, clarity, carat weight, crystal etc. What should one pay attention to first and last?

GS: The emerald needs to speak to you. You need to look into it and be seduced, in some way, by its appearance. Look at its colour first – this is the most important thing in an emerald. It can have the best clarity and be of a large size, but it needs to have a very rich vivid-green colour. Clarity, however, comes a close second. You have to consider that eye-clean emeralds rarely come in sizes above one carat and generally exhibit inclusions that experts call ‘jardin’ (garden). Such stones are more highly valued than the flawless emeralds that lack the limpid quality of a good crystal.

International Emerald Exchange mined Colombian emeralds. Photo credit: Juan Cristobal Cobo

KP: What is your advice to those who want to buy emeralds for investment but do not have specialist knowledge?

GS: I believe that not understanding precious stones is really the reason why gemstones haven’t become more popular as an investment. But nowadays, with the Internet and availability of books, you can educate yourself and there’s no excuse not to do so. Before you go and see a dealer, preferably someone who is established or operates in very transparent manner, list out your questions and get him to answer them. Nowadays, the industry is becoming a lot more transparent because you can easily and quickly verify online whether someone has had a positive or negative experience with a particular dealer or company.

KP: Is there anything else one needs to consider?

GS: You also have to pay attention to stone treatments, as majority of emeralds on the market have been oiled or filled with resin to enhance its appearance and seal fractures. Though these methods make the emeralds more attractive, they reduce the gemstone’s value.

International Emerald Exchange cut and polished Colombian emerald of cushion shape. Photo credit: Juan Cristobal Cobo

KP: Why is buying from a gemstone dealer (like yourself) a better option than an auction house or a respected jewellery brand?

GS: In this case, you have to understand the supply chain. Sometimes, there are a huge number of people involved between the mine and the seller. It’s not uncommon for those of us in control of one or two mines in Colombia to sell a rough stone to someone in the mining region, who would then sell it to someone else in Bogota. This buyer would cut, polish and sell the stone to another dealer in Bogota, who would then sell it on to an international buyer in New York or Hong Kong, where the jeweller would repurchase it. After the stone is brought to Europe and gets mounted in a piece of jewellery, it finally ends up in a shop window. A stone can sometimes pass through so many hands before it reaches the final client! Dealing with IEEX is different, as we operate at the source and control every aspect of our supply chain. We mine the rough stones, cut and polish all of them in our Bogota workshop and then export it directly to our clients. Therefore, we condense the supply chain; by doing this, we add value to what our clients buy.

WORDS

Katerina Perez is a jewellery insider, journalist and brand consultant with more than 15 years’ experience in the jewellery sector. Paris-based, Katerina has worked as a freelance journalist and content editor since 2011, writing articles for international publications. To share her jewellery knowledge and expertise, Katerina founded this website and launched her @katerina_perez Instagram in 2013.